Having the ability to prepare an accurate financial picture of an enterprise and keep records organized is essential for being a bookkeeper. As a bookkeeper, you will need to learn how to create balance sheets, invoices, cash flow statements, income statements, accounts receivable reports, and more. Although software and calculators do most of the math, basic skills such as addition, subtraction, multiplication, and division are essential to helping you catch errors quickly. When choosing a career, going through the challenges you might face is crucial. The integration of technology in financial processes requires bookkeepers to continuously update their skills and adapt to new software and systems.

Every business step requires capital, from transforming an idea into a model to investing in its expansion. As a professional bookkeeper, you would keep track of a company’s financial transactions and record them in the general ledger accounts. Both accountants and bookkeepers work to maintain accurate records of finances, and sometimes the terms are used interchangeably. Generally, bookkeepers focus on administrative tasks, such as completing payroll and recording incoming and outgoing finances. Accountants help businesses understand the bigger picture of their financial situation. You can create a custom bookkeeping skills assessment to evaluate your candidates’ understanding of fundamental accounting principles and test proficiency in popular bookkeeping software.

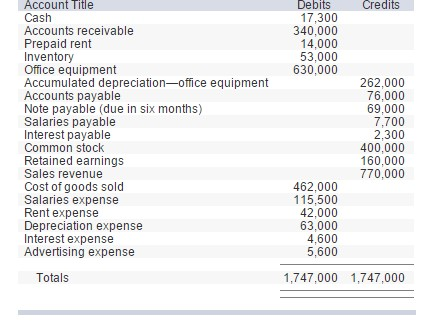

A Bookkeeper is responsible for recording and maintaining a business’ financial transactions, such as purchases, expenses, sales revenue, invoices, and payments. They will record financial data into general ledgers, which are used to produce the balance sheet and income statement. Bookkeeping is the process of keeping track of industry theory a business’s financial transactions. These services include recording what money comes into and flows out of a business, such as payments from customers and payments made to vendors. While bookkeepers used to keep track of this information in physical books, much of the process is now done on digital software. Modern accounting software is the repository of all financial transactions for your company and can generate requisite reports in real-time.

Understanding of accounting principles bookkeeping skills: Accounts payable and accounts receivable

If you are passionate about working as a bookkeeper, there are certain skill sets you need to have under your belt in order to succeed in the field and become a professional. Bookkeeping skills play an essential role in any business organization by allowing professionals to record accounting transactions and issue important financial statements. A bookkeeper’s work helps to provide company owners and managers with the data to make key decisions that they wouldn’t be able to make without. As technology continues to shape the domain of Bookkeeping, proficiency in using accounting software and navigating data entry processes becomes one of the indispensable Bookkeeping Skills. Also, these professionals stay updated with the latest software and tools to stay ahead in the field.

- Ideally, Bookkeepers should stay updated with industry changes and refresh their skills annually.

- As previously mentioned, being good at data entry also requires excellent computer abilities as well as the capacity to adapt to new technology.

- The data you are given may be very confidential, specifically the ones involving financial transactions.

- The expected job decline is primarily due to cloud computing and other software innovations automating bookkeeping tasks that a person would normally do.

- Time management greatly benefits from automating manual processes such as invoicing, payroll, inventory, and accounting with bookkeeping software.

Knowledgeable with bookkeeping concepts

After completing your education, you can seek an internship and get on-the-job training to become a bookkeeper. However, it helps to have a two- or four-year degree in accounting, finance or related discipline. If you want to be a great asset to the company you work for, you need to think long-term so that you can see the bigger picture. If you are prone to making impulsive and uninformed decisions, then this role may not be for you. Being able to see beyond the numbers and anticipate potential threats can help you become a great bookkeeper.

What is the difference between accounting and bookkeeping?

By implementing these strategies into your professional journey, you can proactively enhance your Bookkeeping Skills. Remember, the key lies in a commitment to lifelong learning and an openness to embracing the evolving landscape of Financial Management. Unlock the essentials of Bookkeeping with this blog on 12 key Bookkeeping Skills.

A bookkeeper is responsible for recording and maintaining a company’s daily financial transactions. They also prepare reports for the managers and trial balances to assist the accountants. A bookkeeper may also help you run payroll, collect debts, generate invoices and make payments. Bookkeepers are tasked to efficiently manage the financial records of their clients. Some of their other responsibilities include managing ledgers, keeping financial transactions, handling accounts payable and receivable, managing payroll, and assisting with tax preparation and filing.

What is Bookkeeping?

These courses focus on bookkeeping fundamentals to help improve bookkeeping knowledge and skills. For example, you might complete the Intuit Bookkeeping Professional Certificate or several other bookkeeping courses offered by universities and companies on Coursera. Integrity and trustworthiness are important qualities to cultivate as a bookkeeper. Keep an organization’s financial data confidential and be transparent about your bookkeeping activities. Empowering precision in financial management through expert software use, meticulous record-keeping, and robust fiscal analysis. Certifications aren’t necessary to become a bookkeeper but can signal to employers that you have the training and knowledge to meet industry standards.

Bookkeepers are important professionals in today’s economic and financial fields. Every company, even a small one, requires bookkeeping to maintain a healthy financial position. Two of the irs 2018 form w most common are single-entry bookkeeping and double-entry bookkeeping. A seasoned small business and technology writer and educator with more than 20 years of experience, Shweta excels in demystifying complex tech tools and concepts for small businesses. Her postgraduate degree in computer management fuels her comprehensive analysis and exploration of tech topics.

For example, Dyninno Group, a group of companies covering five sectors under one umbrella, used communication and other tests to improve its recruitment productivity by 400%. Communication is paramount for companies that expand rapidly and cover how do rideshare uber and lyft drivers pay taxes multiple sectors like finance, technology, and travel under the same roof. Using these tests in conjunction with an in-person interview can give you a holistic view of your bookkeeping candidate. Our Culture Add test enables you to customize your assessments to determine whether your candidates align well with the rest of your company. It can be difficult to assess how well a candidate’s values align with your company’s. The IFRS test measures a candidate’s ability to work according to International Financial Reporting Standards.

Leave a Reply